Penny-wise, Pound-foolish with your estate?

Learn the 6H1W of Holistic Legacy Planning at just $39!

Official partner of heritance App.

SmartWill Promo Code

LIGHTHOUSE30

Our Solutions

We are passionate to guide people to leave their hand-prints beyond their lifetime. Whether you are a professional or business owner, we partner you to design and build your unique brand of legacy, through corporate talks or one-to-one consultations.

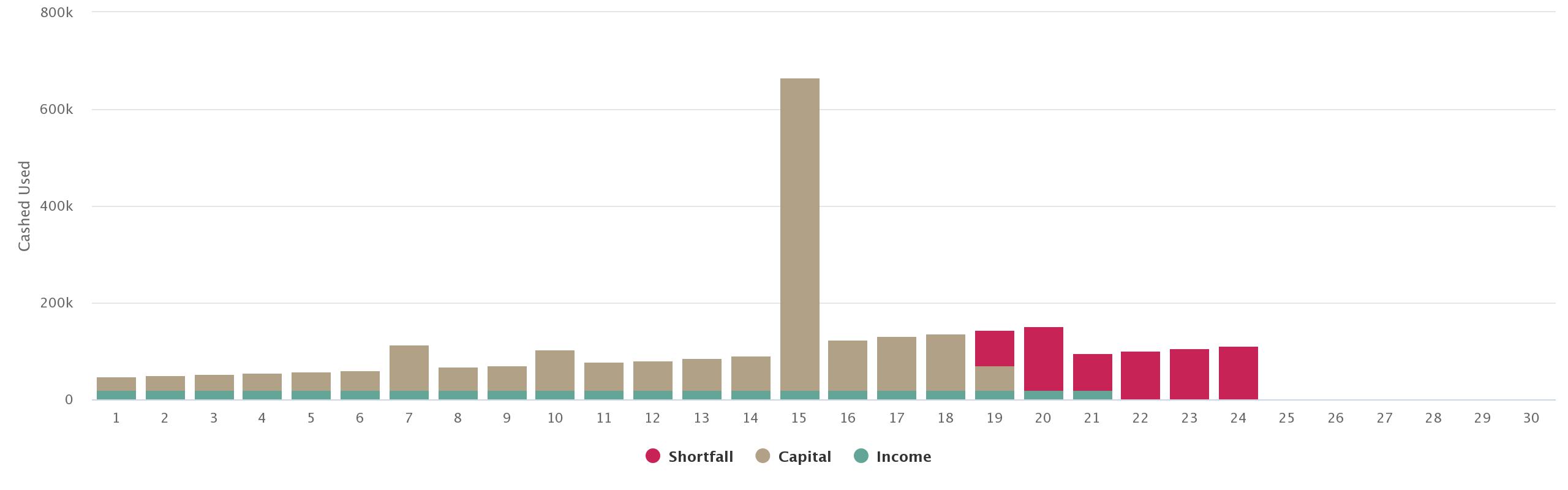

'3 cheques' Scenario Planning

Balancing your Retirement and Legacy

3-in-1 Family Trust Planning

Structuring for dignity and peace of mind

Multi-Generation & Philanthropic Giving

From Success to Significance

How We Work?

Whether it is your family or business, our consultation approach is build on the principle of prescription after diagnosis. We believe in client’s education and mutual discovery, before arriving at the most cost-effective legacy solutions. Our consultation process starts with three steps.

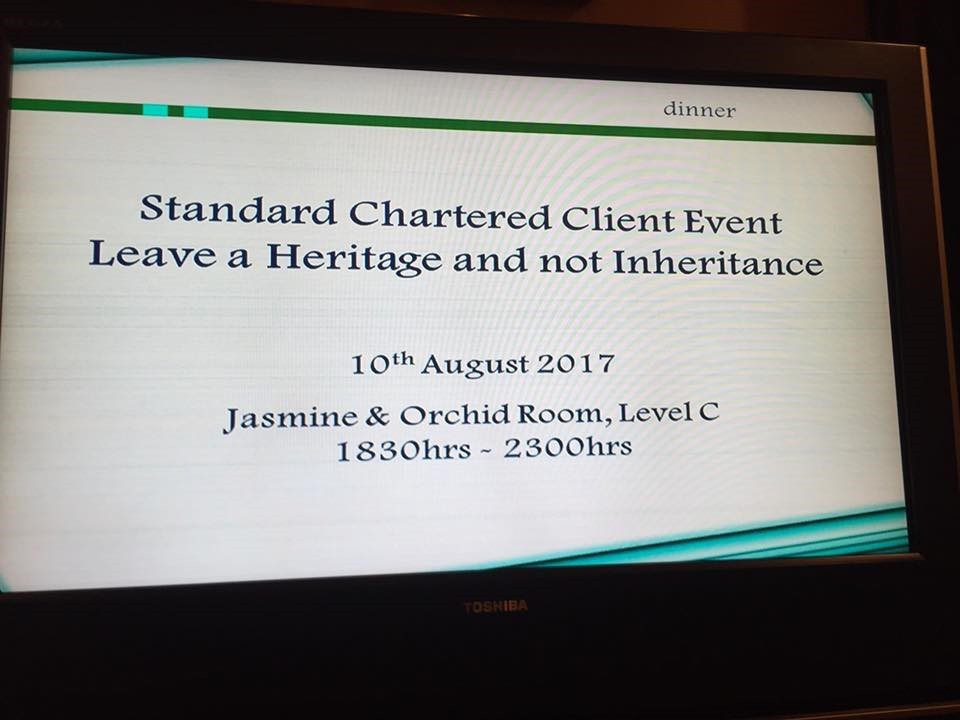

1. Workshops & Seminars

Most participants start with the process after attending our seminar or half-day workshops. They love our programs that do not focus on technical or legal jargons, but that promotes learning and self-discovery. Participants learn practical tips that will empower them to start their legacy planning journey. One in three usually follow up with a one-to-one consultation.

2. Initial fact-find & Consultation

Every family circumstance is unique. It is not just who are in your family or what assets you own, but also how you feel and what you know about them that is important. We do not charge for our first consultancy until we are confident we can add value to your legacy.

3. Engagement & Onboarding

Once we are clearer about your circumstance and objective, and are confident to add value to your legacy plan, we will prepare a customized quote and letter of engagement. The onboarding, planning and execution process takes roughly one to two months. In some cases, we may bring in relevant specialists in the area of wealth management, tax or business consultancy. Make your non-obligatory appointment with our consultant today.